We provide accurate, objective, accessible, and cost-effective valuation for technologies and enterprises.

Valuation Product Introduction

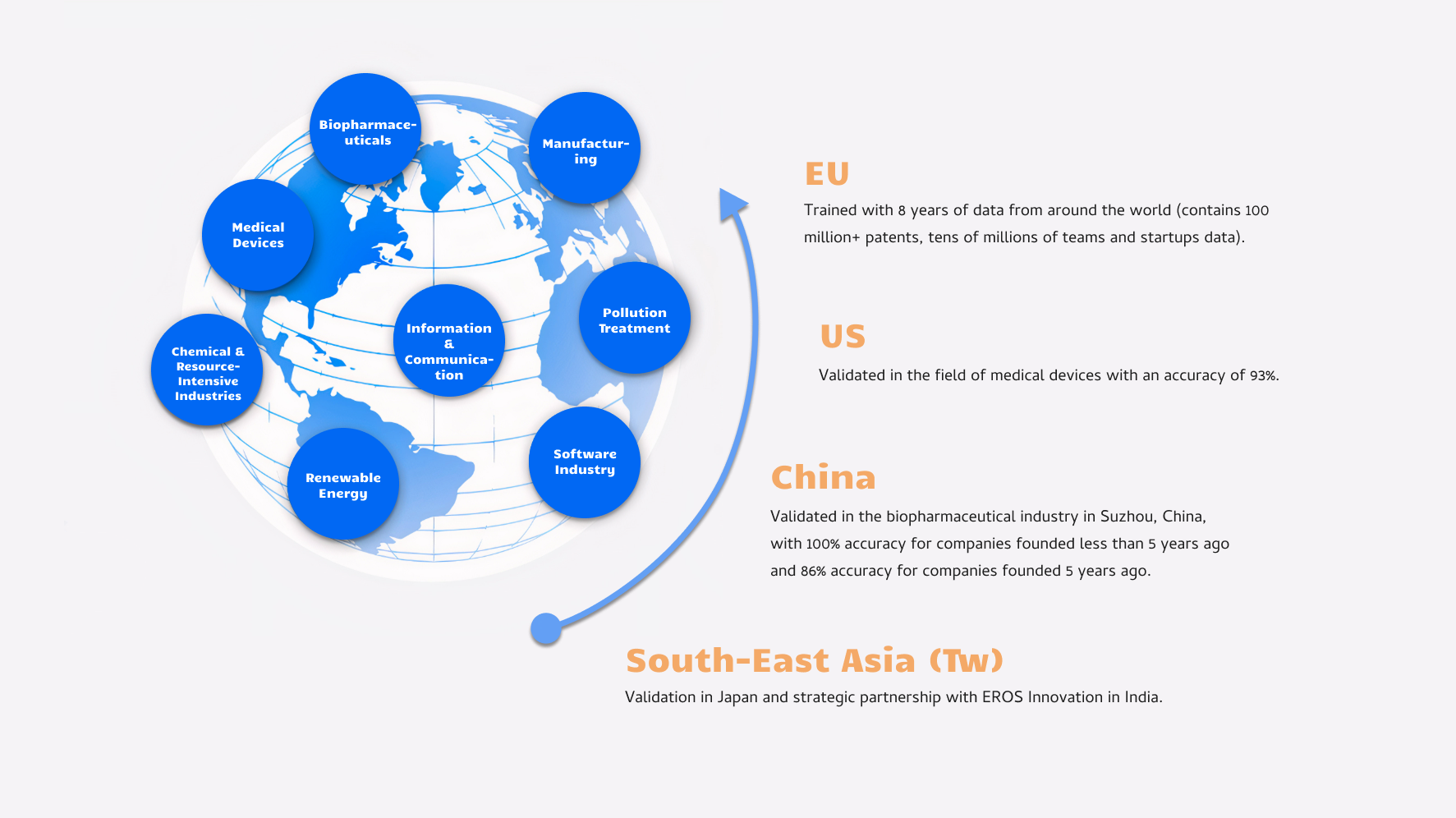

The first AI valuation engine

OxValue valuation model is built on one theoretical framework, supported by two types of databases, driven by three AI dimensions, and ensures comprehensive data compliance.

Technology Appraisal Approach

Make Informed Choices.

• Supporting technology investment, transfer, and commercialisation

• Designed for:

– Technology investors,

– Startups and enterprises,

– Commercialisation and technology transfer entities,

– Financial institutions and banks

Our Methods and Uniqueness

Service Overview

Our business services encompass rapid screening, valuation, reporting, platform development, and additional support offerings

Integrate Powerful Valuation Capabilities

Platform Development

– Co-develop third-party platforms via API integration

– Embedding valuation services into finance-tech-trading systems

– Supports flexible architecture and localised deployment

– Delivering standardised and scalable solutions tailored to client needs

Valuation presentation

Present Value with Authority and Trust.

• Offers a widely accepted, authoritative valuation for unbiased technology evaluation.

• Ensures fairness and transparency for both transaction parties, building trust in technology transfer and investment processes.

Determine Fair Equity Value with AI-Powered Precision.

• Provide valuation of target equity, supporting reasonable transaction pricing

• Incorporates market analysis, competitive benchmarking, and company lifecycle assessment

• Considers historical data and growth projections

• Powered by an AI model to compute enterprise equity value

• Designed for VC firms, investors, M&A activities, and multi-equity transaction scenarios

Establish Accurate Debt Value for Informed Credit Decisions.

• Provide valuation of target debt, supporting reasonable credit pricing

• Tailored for the banking and financing sectors

• Integrates market data, competitor analysis, and industry cycle trends

• Utilises a specialised AI algorithm to assess and calculate enterprise debt value

• Focuses on debt-side enterprise evaluation